Español l Inglés

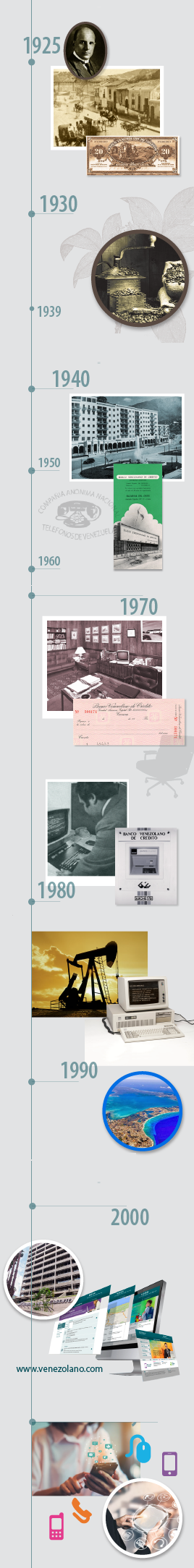

The Beginnings: We opened our doors for the first time on June 4,1925 in a small premise located in Sociedad a Traposos, in the center of Caracas, being pioneers among private financial institutions in Venezuela. Operations began with a capital of Bs.6,000,000.00 and loans for Bs. 10,027,072.00.

By then, Caracas had a population of 186,000 inhabitants; oil was a new term in our economy and giving credit, as it is known nowadays, was quite a challenge.

The Pioneers: The inspirers of the project were a group of young Venezuelan businessmen led by Henrique Pérez Dupuy. Since its inception, Venezolano de Crédito actively participated in the development of the country, extending credits to the most productive areas of the economy.

In the 1930s, we fully funded the first expansion project of the city of Caracas and in 1936 we offered credit facilities for coffee sowing activities. During the difficult years that followed 1930, our strong presence guaranteed the continuity of companies that constituted an important source of jobs for the Venezuelan economy. Until 1939, when the Law of the Central Bank of Venezuela was enacted, we issued our own paper money.

The Expansion: In the 1940s, we extended our financial support to the most important private companies of the time, including the Compañía Anónima Nacional Teléfonos de Venezuela, La Electricidad de Caracas, large urban development companies and an airline.

Growth was signicant in the 1950s. Some new commercial offices were inaugurated in Caracas, but other states of the country were served through partnerships with other institutions. During those years, we continued to support important industries in various sectors of the economy.

Five commercial offices, together with the head office in Caracas, evidenced the expansion of our Bank in the 60s. Towards the end of this decade, we had a capital of Bs. 52,500,000.00 and reserves for Bs. 37,032,389.75.

The Modernization: The 70s were marked by growth and the modernization of the Bank throughout the country. Many commercial offices were inaugurated in some important cities across the country, helping consolidate growth and development in Maracaibo, Valencia, Maracay and Barquisimeto.

Marking our entrance into technology, we developed an online system allowing payment of checks in or our offices in the country. In this period, we emphasized our support to the oil sector and we created a specialized unit to cater our corporate clients.

In 1975, we acquired Soficredito, a company focused on long-term financing term in the areas of vehicles and real estate. In the 1980s, we established Sogecredito, in response to our clients' needs to finance long-term capital assets through novel mechanisms such as financial leasing. We also continued our modernization processes - both in products and services - and our expansion, opening new commercial offices. Also in this decade we were co-founders of the first network of Automatic Teller Machines (ATMs) in Venezuela, Suiche 7B.

Leaders in Securities Management: At the beginning of the 90s, we became leaders in specialized securities services, innovating through services such as Transfer Agent (book keeping of shares for large corporations) and Custodians of major local and foreign programs of ADR and ADS. Also in this decade, we consolidated our presence in the oil sector and we started a program to open Corporate In-branches within the most important corporate and oil companies.

In 1996 we became the first Venezuelan financial institution with a presence on the New York Stock Exchange, through a ADR's issuance program in which The Bank of New York acted as guarantor. Internationalization was accentuated in 1998 with the opening of an international office in Grand Cayman, Cayman Islands, B.W.I. Also in 1998 we cofounded the network “Conexion Americas”, created to provide services to multinational clients throughout the continent, in alliance with Bank of America.

The Merger: In June 2001, our Board decides to initiate conversion to Banco Universal, a banking figure designed to extend all types of credit under the same company. This was executed by absorption of Soficrédito and Sogecrédito, registering all the corresponding documentation on January 24, 2002. The merger allowed us to further raise our administrative efficiency, optimize processes and expand the portfolio of products and services to our clientele.

Likewise, an important process was carried out to open commercial offices in important commercial and retail companies, reinforcing the strategy of attention to payroll and recruitment of new clients in traffic affluent spaces.

The New Century: With the unstoppable technological boom of the 21st century, we oriented our strategy to development and promotion of digital channels, developing our first office banking for companies (Venecredit Office Banking) and an internet banking for individuals (Venezolano Online); as well as our webpage and advanced mobile banking services. Through these years we have led the development of solutions under the umbrella of the Visa franchise, pioneering the launch and commercialization of different programs for payments and collections.

We welcome the new times: we have focused on promoting our clients´ transactions adapted to self-management models. Important alliances have been established with corporate clients, to design a Collections System designed to streamline processes, optimize cash flow and automate conciliation.

We created mobile payments through P2P and P2C services and are continuously taking steps to foster and enhance digital transformation to keep us at the top of the new banking era.